Introduction and research objectives

This time five years ago, the everyday consumer likely didn’t think about supply chains regularly; the majority probably never gave them a second thought. But the last few years have highlighted just how fragile supply chains are, with events such as Brexit, Covid-19 and the blockage of the Suez Canal all highlighting how the movement of products around the world can be impacted with little to no notice.

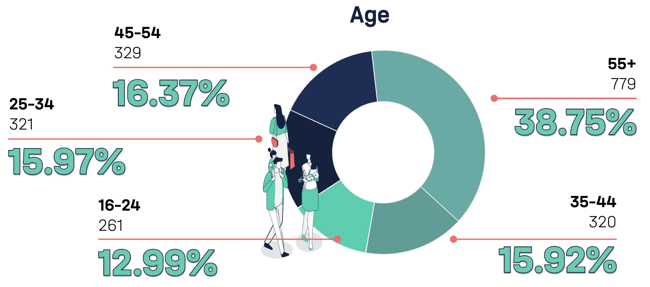

Whilst ‘supply chain issues’ may be a phrase that has become an increasing part of daily life, the potential brand damage that shortages are causing cannot be underestimated. In fact, we found that in just the last three months, 43% of consumers have been impacted by supply chain disruptions and 47% think brands can be doing more to prevent them.

What you will learn:

- Which industries consumers think are most affected by supply chain disruption

- How disruptions have impacted customer loyalty and who they think is responsible

- What to prioritise to combat ongoing issues and how technology and automation leaves you room to innovate and create a resilient supply chain

- How moving from a reactive supply chain strategy to an outcome-driven one will not only protect you from the volatile environment we live in but also turn your supply chain into a competition advantage.

Which industries are the shortages affecting? No sector is exempt: from a lack of basic items such as eggs and tomatoes in supermarkets, antibiotics and cold and flu tablets in pharmacies, to a shortage of chicken forcing a weekly offer at KFC to be paused, these instances are becoming increasingly regular across a range of sectors.

For consumers, these shortages may not only cause frustration, but could ultimately also have a lasting impact on loyalty if they are forced to go elsewhere to get a hold of items.

The aim of this research was to examine the potential damage to brands when shortages occur. Within this, we wanted to investigate which products and items shoppers have experienced shortages in, how this is affecting their purchasing habits and what impact supply chain issues are having on brand health and long-term customer loyalty.

Methodology

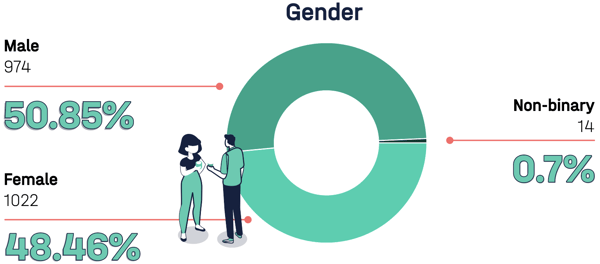

In March 2023, 7bridges conducted the following research with an independent market research consultancy, Censuswide. 2,010 nationally representative UK consumers aged 16+ were polled between 03.03.2023 and 06.03.2023. The demographics were as follows:

Key results

Have you experienced supply chain disruption when trying to purchase goods in the past three months?

When looking at frequency of supply chain issues, on average UK consumers are unable to get hold of a specific item 1.66 times per month. For 22% this was once a week and over half reported this monthly.

In today’s world where we are so used to having everything at the drop of a hat, the frequency, whilst not surprising, will cause problems as consumers are less forgiving.

Thinking about your shopping habits during the last 12 months, how frequently have you been unable to get hold of a specific item in a supermarket/restaurant/shop/pharmacy?

.png?width=200&height=123&name=Consumer%20data%20report%20-%20frequency%20(1).png)

.png?width=200&height=127&name=Consumer%20data%20report%20-%20frequency%20(2).png)

.png?width=200&height=182&name=Consumer%20data%20report%20-%20frequency%20(3).png)

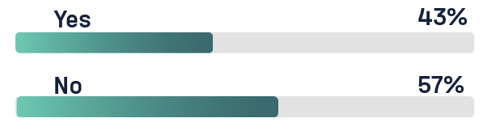

Have you experienced supply chain disruption when trying to purchase goods in the past three months?

When we split our supply chain disruption geographically we see an interesting picture. Scotland and Northern Ireland are most affected, with London coming in third. These three areas are above the national average of 43%.

Northern Ireland is 10% higher than the national average in fact. This is likely due to Brexit and increased shipping costs since the UK exited the EU. In fact, in December 2022, it was reported that Northern Ireland manufacturers had over £1.2 billion worth of goods sitting in warehouses awaiting completion due to missing parts and materials.

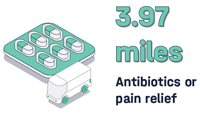

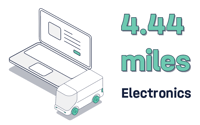

Thinking about your purchasing habits, how far would you be willing to travel to get hold of the following items if they weren’t in stock locally?

Average distance people would travel:

Next up, we asked the consumers how far they would be willing to travel to get hold of out of stock items. What’s interesting here is that the less ‘essential’ the item is, the further people are willing to travel.

Groceries were the shortest distance, perhaps telling us that people will shift their shopping list if necessary. Additionally, groceries are a more frequent purchase so the willingness to travel probably decreases as food shopping should be more convenient. Furniture reported the furthest distance, implying that for bigger, less frequent purchases, consumers are happy to travel greater distances.

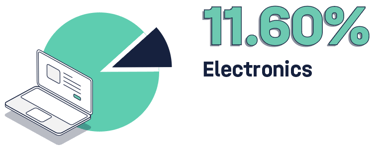

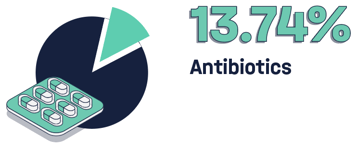

How much more, if anything, would you be willing to spend to get hold of the following items without having to go elsewhere?

Average extra that consumers are willing to spend:

The clear winner here is antibiotics, where consumers are willing to spend 13.74% extra to get hold of them. This shows that consumers are willing to pay more when it comes to healthcare in particular. Of those asked, 49% of the consumers said they would pay more for antibiotics.

The results imply that, post-covid, customers better understand the complexity of pharmaceutical supply chains after being exposed to so much media coverage of them during the last few years. Medicine is clearly not an item that people want are willing to wait for and they will pay for the privilege of getting access to it.

Clothing was the category that consumers were least likely to spend extra to get hold of. With such a wide variety of clothing stores available to customers and a plethora of choice, this shows that customers are more willing to either buy something different or shop with another brand to get what they want.

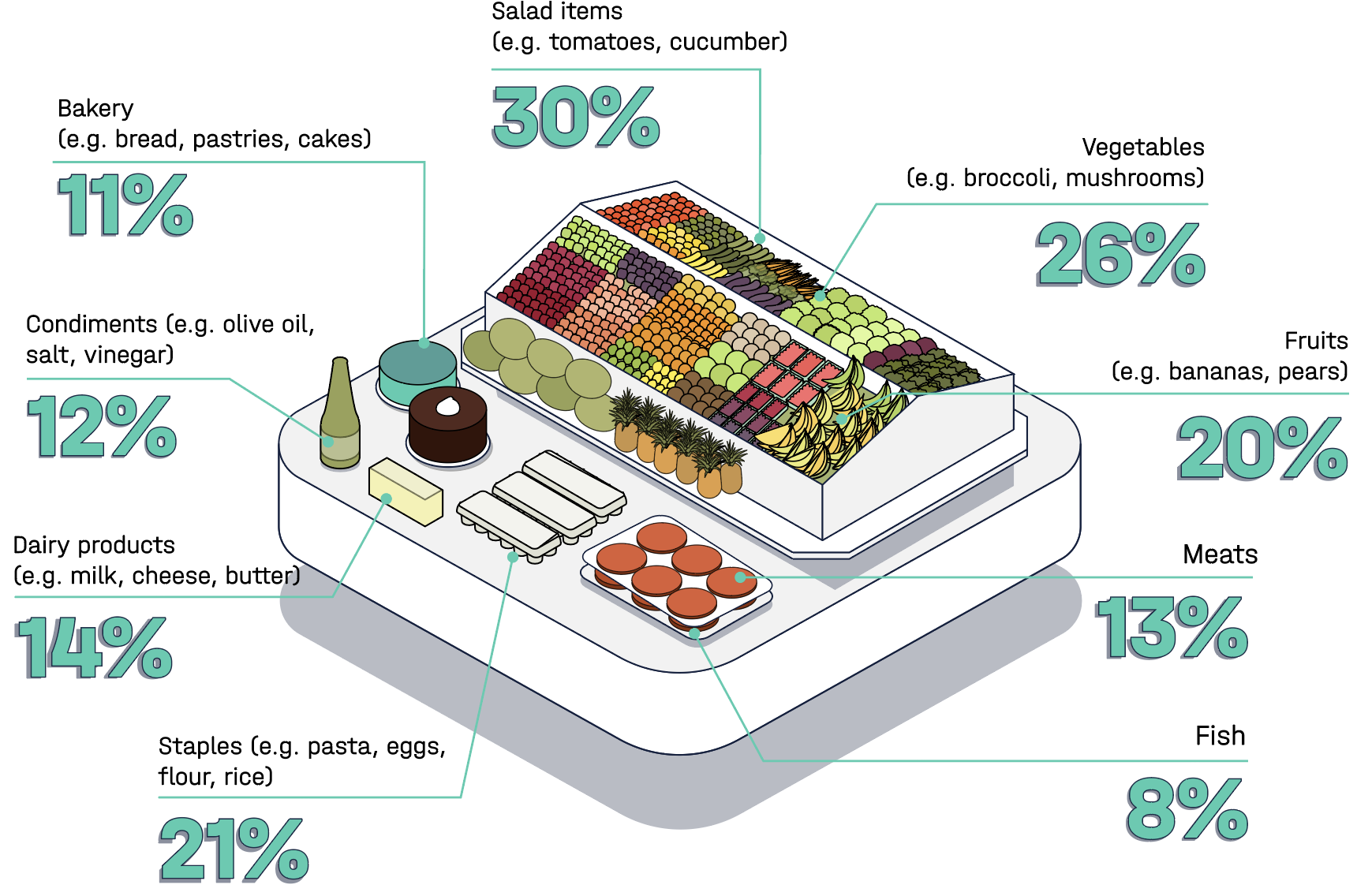

When undertaking your regular supermarket shop in the last 12 months (online or in-store), within what categories, if any, have there been items you’ve been unable to get hold of?

The media has been rife with stories of empty shop shelves in supermarkets. Most recently, soaring costs and unpredictable weather impacted salad supplies of key items such as tomatoes and cucumbers. We’ve also seen rations on eggs last year.

We polled UK consumers and asked them which categories they’ve been unable to get hold of in the last 12 months. The results are not surprising but shed light on the real issue the UK food supply chain is experiencing when it comes to grocery shopping.

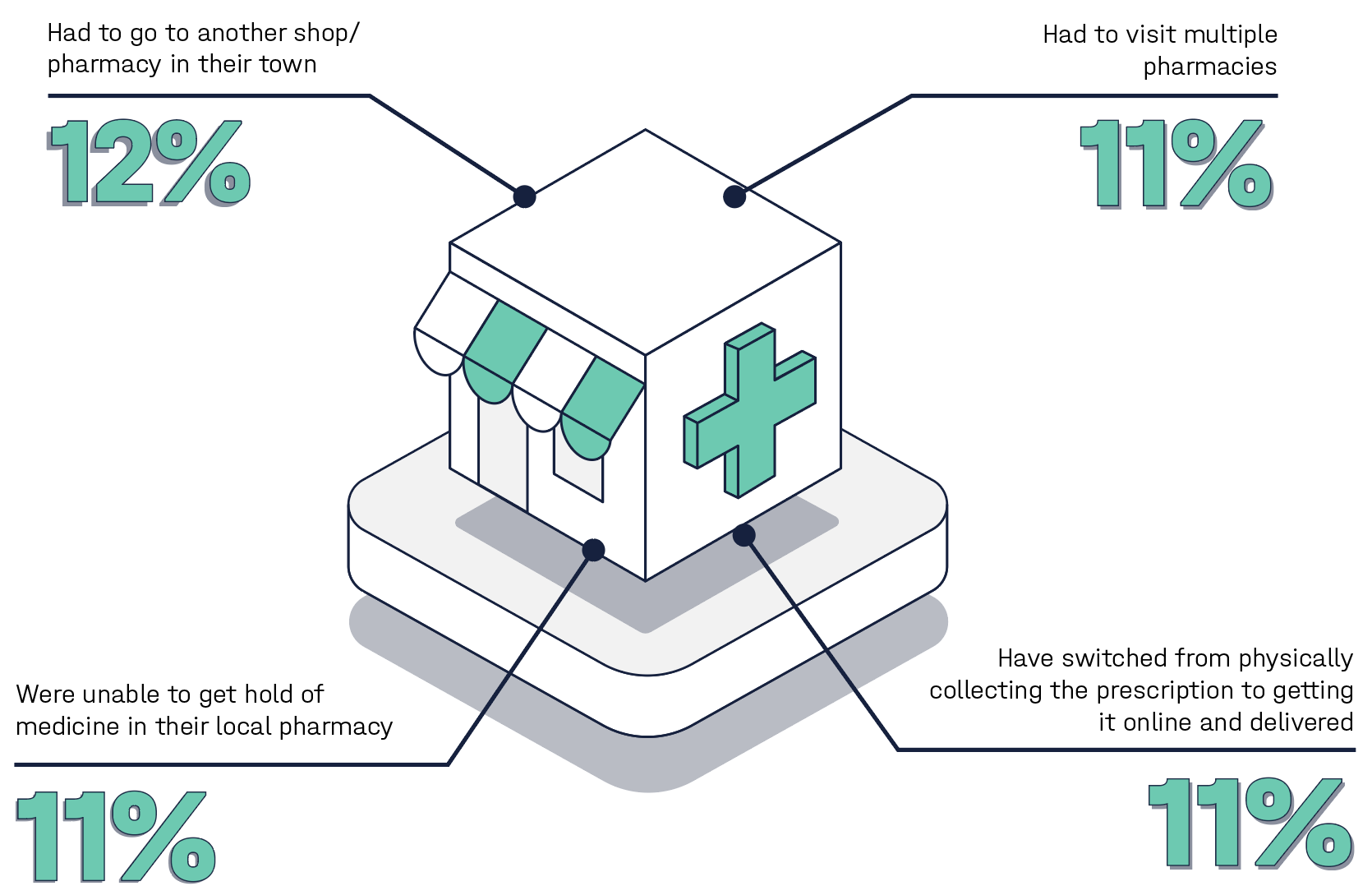

In the last 12 months, which of the following, if any, have you experienced when trying to get hold of a prescription? (Tick all that apply)

Next up is healthcare and, more specifically, prescriptions. Antibiotics shortages were a huge problem in the UK towards the end of 2022 and early 2023, which is reflected in the data. 12% of consumers surveyed had to go to another shop or pharmacy to get their medicine and 11% had to go to multiple pharmacies.

When you consider that not everyone in the pool of respondents will have needed medicine during the last 12 months (roughly 4 in 5 people need a prescription each year), the number who struggled to get access to it could become a major issue if problems arise again.

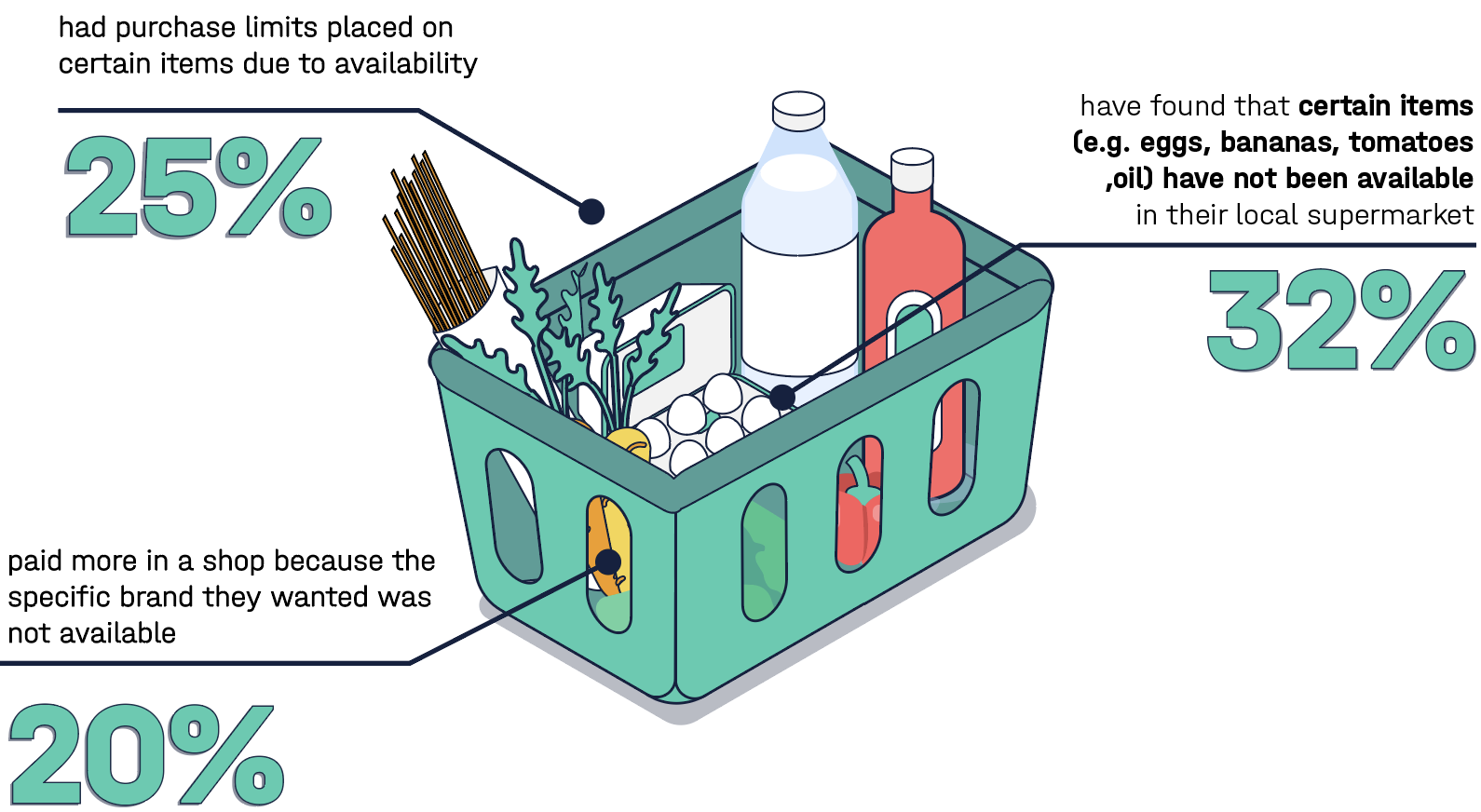

Now we understand the picture of supply chain disruption in the UK, let’s look at the impact this has had on consumers. First up, we asked consumers which scenarios they had experienced:

Thinking about your experiences generally over the last 12 months, including shopping, which of the following scenarios, if any, have you encountered? (Tick all that apply)

The most worrisome point here is that 20% of consumers had to pay more in a shop because a specific brand wasn’t available. With the current cost of living crisis, consumers are being more careful with how and where they spend their money.

If they are regularly having to spend more due to stock issues, they may decide to shop elsewhere permanently. We’ll come onto that in more detail later in this report.

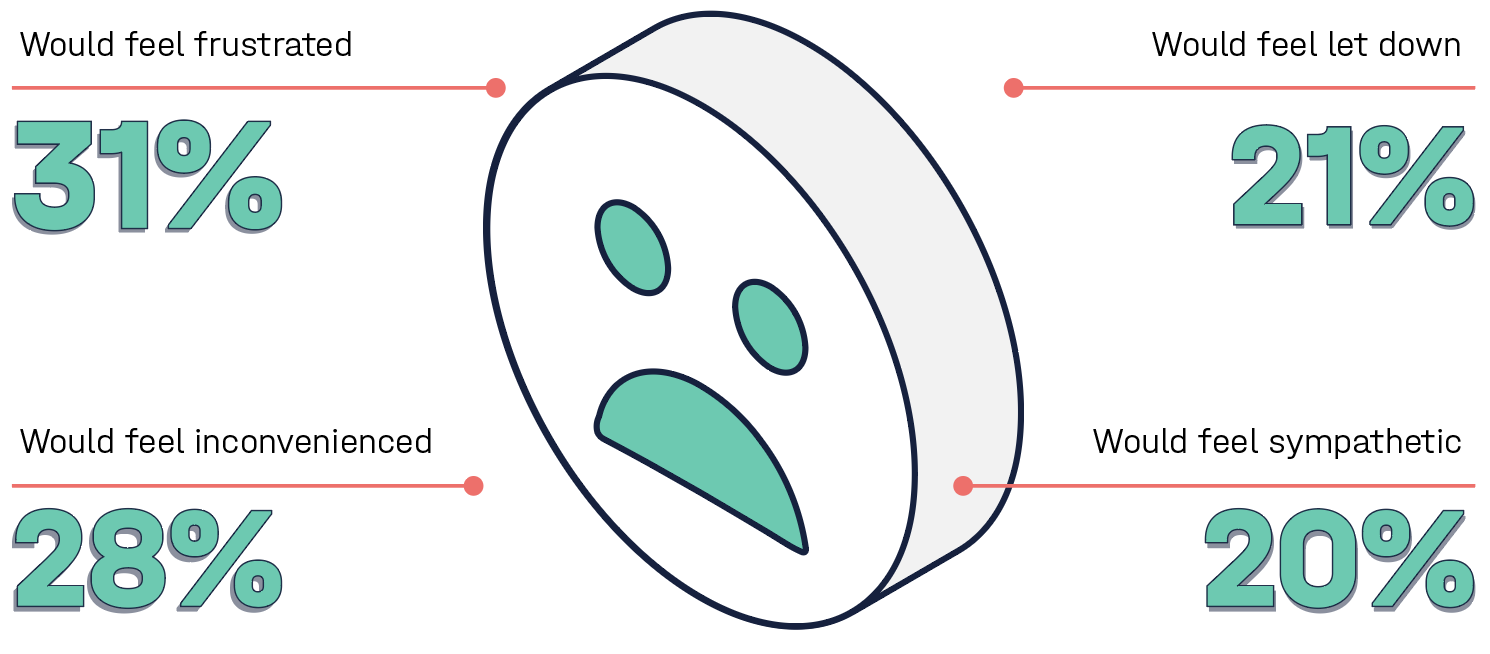

Shopping is a very emotionally driven activity. The consumers buying your goods therefore often have emotional responses to positive experiences, and negative ones too. We asked how supply chain disruptions made the respondents feel:

Imagine a brand/retailer/pharmacy you shop with regularly cites ‘supply chain disruption’ as the primary reason for shortages of a particular item you like to buy. How, if in any way, does this make you feel towards this brand? (multiple answers possible)

For 1 in 3 to describe themselves as frustrated when faced with supply chain issues is very telling on consumer sentiments at the moment. We’ve been plagued with issues for the last three years and customers are likely getting tired.

The problem is, these disruptions are not going away anytime soon. So what should you do? Keep reading to find out…

Perhaps one of the most important questions in the study was whether customers would be less likely to shop with brands who regularly cite supply chain disruption for stock shortages. Over 1 in 3 (39%) of the respondents reported that they would be, which is a major cause for concern for businesses.

To what extent do you agree or disagree with the following statement?

If a brand/retailer/pharmacy I shop with regularly cited supply chain disruption as the primary reason for shortages of an item I like to buy, I would be less likely to keep shopping with them.

Agree they would be less likely yo shop with a brand/shop/pharmacy that regurlarly uses supply chain disruption as the reason for shortages

Furthermore, almost half of the respondents believe that businesses could be doing more to prevent the level of disruption we’ve seen. This is very telling on the consumer sentiment towards the issue. The assumption can be drawn that they believe that supply chain professionals should be able to overcome this and that they as customers shouldn’t be affected by issues in the industry.

Thinking about your regular purchasing habits, how much do you agree or disagree with the following statement?

I believe businesses could be doing more to prevent the level of supply chain disruption we are currently experiencing.

Believe that busenesses can be doing more to prevent the levels of supply chain disruption

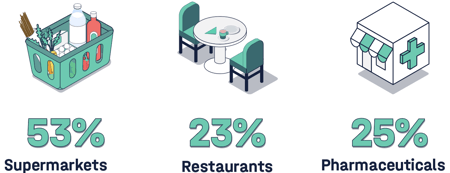

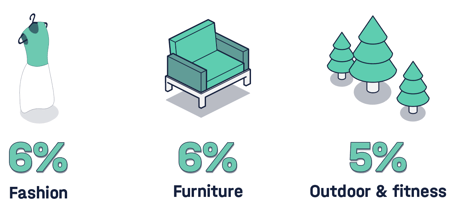

Thinking about supply chain disruption in general, what sector(s), if any, do you believe are the most impacted?

Let’s look at which industries consumers think are most affected by supply chain disruption. I don’t think the top three are surprising here, especially supermarkets and pharmaceuticals.

Following on from the mass shortages in outdoor and fitness goods during Covid-19 lockdown, it is good to see this sector sit at the bottom of the group.

Whilst the three least impacted have low scores, we can all agree that they are by no means clear of disruptions. The top industries have had a particularly troublesome time recently but the overall issue remains for most sectors. Thinking about supply disruption in general, what sector(s), if any,

Top three most impacted sectors:

Top three least impacted sectors:

Which of the following statements, if any, do you agree with most when thinking about how disruption could influence the brands you shop with this year?

Finally, we asked the consumers how disruption could influence the brands they will shop with this year. Almost half of the respondents said they will try and shop with the brands they are loyal to, but if shortages are present they will look elsewhere.

16% said they will likely shop with different brands altogether which is a surprisingly high number. When you think of this in terms of revenue, a 16% drop could have a catastrophic impact on business goals.

Will likely continue to shop with the same brands as far as possible, but will look elsewhere for similarly priced items that aren’t available at that particular store

Will likely shop with different brands altogether to have confidence that products they want will be available

Do not believe there will be any disruption influencing the brands they shop with this year

With supply chain disruptions now a day to day challenge, what should you do?

One of the best ways to ensure your supply chain can handle disruption is to stress test it thoroughly.

What is stress testing in the supply chain?

Stress testing refers to putting something through its paces to see if, or more realistically where, it breaks. The idea is to identify weak points and recommend ways of fixing them going forward.

In supply chains, however, actually pushing things until they break can be disastrous. That’s why stress testing is more commonly done with data than live supply chains.

Instead of relying on purely historical data that is outdated, modern supply chains need to use AI for scenario planning and stress testing. As AI and machine learning get more advanced, their ability to create effective simulations only grows.

Simulated breaking points

So how do these AI simulations work? At the most basic level, you feed data into an AI platform like 7bridges which combines it with a bunch of other data that it has rolling around in its ‘brain’ and out pops a digital twin of your supply chain. The truth is that it’s quite a bit more complicated than that, but it’s conceptually similar.

Digital twins are essentially virtual copies of your supply chain. They should function identically to what you see in real life, but with one major advantage: if you break it, nothing bad happens. So digital twins are ideal for scenario planning. You can change the parameters you want to test and figure out how that could impact your supply chain.

If, for instance, you wanted to see how your supply chain will cope without being able to go through a huge geographical region, you can factor that in and test it. You can test port closures, sudden demand or even another lockdown. Or what happens if one leg of your supply chain is in a climate vulnerable area?

How does it keep moving? Getting answers to these questions is what stress testing is all about.

One of our customers did exactly this when faced with upcoming carrier strikes. They were set up ready to simulate what would happen if they changed carriers and what it would cost them. When strikes hit, they could easily change their delivery provider at the push of a button and their end customers were none the wiser that a disruption had happened.

How an outcome-driven supply chain strategy can help alleviate the impact of supply chain disruptions

For far too long, supply chains have been managed reactively, instead of being driven by outcomes and possibilities. Which is why tackling the many priorities you have as a supply chain professional can be a struggle.

Outcome-driven supply chains shift the focus towards a more holistic approach that fully considers business goals and strategy. Which means more of the work you and your team do makes a difference to the bottom line.

Outcome-driven supply chains need to be powered by data and machine learning and holistically focus on strategic outcomes for the wider business.

But how? After all, we’ve seen it before: traditionally a large change process is needed and it takes a lot of money and a long time to implement. Instead, by building iteratively with business outcomes in mind and using the 7bridges platform, reinventing your supply chain approach can be an efficient, resource-light process.

We believe that the route to an outcome-driven supply chain is to make progressive changes at a pace that suits you, addressing your most pressing problems one at a time, and using the results of one improvement to address the next. That means over time you’re able to make enormous improvements across your supply chain operations without feeling the pain of a massive change project. All while improving outcomes for your overall business and your customers.

Conclusion and key takeaways

So there you have it - the data shows us that recent shortages and disruptions in supply chains are having a big impact on brand loyalty and customer sentiment.

Consumers are frustrated with brands and think they can do more to combat the impact these disruptions have. After the turbulent years of covid, where customers were more forgiving, it is clear that customers are fed up. They are less likely to give brands the benefit of the doubt and are more inclined to shop elsewhere now.

What does this mean for you? The time to act and create a more resilient supply chain that is armed to withstand disruptions has passed - if you are not prepped to do this you are falling behind your competitors and potentially losing customers.

Key takeaways:

- The food industry has been the most affected when it comes to shortages

- Customer loyalty is at risk following supply chain disruptions in recent years

- Customers are willing to travel further for non-essential goods like furniture

- The time to act has passed and brands need to catch up and arm themselves with a resilience, stress-tested supply chain

- An outcome-driven supply chain strategy is the answer to alleviating the impact of supply chain disruptions

Discover our platform

Learn more about the 7bridges AI powered supply chain management solution, and how it can transform your business for a competitive advantage.